3 May 2019

We send a weekly newsletter to keep our supporters informed of tax fairness news. Sign up to receive the newsletter here.

3 May 2019

Another tax deadline has come and gone, but in the remaining days for Canadians to file their taxes, C4TF squeezed in some good discussion about getting government to do the task for us. In an op-ed in the Winnipeg Sun, we point out that the CRA already has much of the information needed to provide citizens with a draft tax return.

While H&R Block, TurboTax and others from the profitable and hard-lobbying tax preparation industry might not be thrilled, draft filing would help ensure our most vulnerable receive all the benefits they’re entitled to. C4TF director Toby Sanger explores these ideas further in an interview with Global News’ 680 CJOB morning talk show. He points to other regions such as Norway and California that have successfully adopted the voluntary system and the significant time and cost savings if Canada were to get on board.

Senator Elizabeth Warren’s proposed corporate tax would apply to profits above $100 million and address many tax loopholes currently used by companies.

Elizabeth Warren’s innovative corporate tax proposal

Massachusetts Senator and Democrat presidential hopeful Elizabeth Warren has come out with a proposal to apply a 7 percent “Real Corporate Profits Tax” on corporate profits of over $100 million. What’s interesting about her proposal is that the tax would address many of the loopholes and other accounting tricks corporations use to report lower profits to the government than they do to investors.

Her proposal was very timely, following a report from the Institute on Taxation and Economic Policy that found that 60 of the Fortune 500 largest corporations—including Amazon—in the U.S. avoided all federal income tax last year. Warren had earlier proposed a wealth tax while colleagues Senator Bernie Sanders and Representative Alexandria Ocasio-Cortez have come out with their own progressive tax pitches.

A New York Times article this week delves into how the demand for a fairer tax system could factor heavily in the country’s election next year as a growing amount of Americans face employment and health struggles.

Political commentator Richard Martineau reacts to C4TF’s release about corporate cash in tax havens.

Tax havens in the news -- again

Our news release last week on how Canadian corporate cash in tax havens has reached record levels generated more media attention this past week with an article by PressProgress and this heated broadcast commentary from TVA Nouvelles that asks viewers to imagine the services that could be provided with all the lost revenue. The issue was also raised in a column in the Journal de Montréal that pointed out the province’s own institutional investor, the Caisse de dépôt et placement du Québec, had investments in tax havens.

Cars idle in traffic during rush hour in Toronto. Michael Gil, Wikimedia Commons

How fair is Canada’s carbon tax?

Opponents of the federal government’s carbon tax—like Doug Ford, Jason Kenney and other conservative premiers—may not have been happy to hear it, but analysis by the Parliamentary Budget Officer found that the large majority of households in the provinces affected will be better off, with most families paying less as a result of the carbon taxes than they receive from the federal “climate incentive payments”. The independent agency found that all household income groups except the top 20% will be better off. Canadians for Tax Fairness and the CCPA have advocated for years for this type of progressive carbon tax, and we’re glad the federal government followed our advice.

However, the Liberal government’s carbon pricing plan goes light on large emitters—which the PBO report also confirms—and it will take much more than a tax on carbon to answer Canada’s urgent climate change problem and the complex economic questions surrounding it. A great column in the Telegram this weekend points out that years of anti-tax sentiment hasn’t helped government sell its carbon pricing plan and a broader, bolder solution is required – one that includes voices from labour who have weathered these economic adaptations before.

QC tax on digital imports doubles expected revenues

Just months after introducing its tax on digital imports, Quebec has generated twice the revenue it had originally estimated, according to an article in La Presse. Quebec’s tax came into effect in January 2019, the same month that Saskatchewan also applied its sales tax to digital imports. The province had earlier pegged revenues at $28 million for the first year, but announced this week that at this rate, it’s looking closer to $62 million annually.

The vast majority of OECD and G20 countries have taken steps to level the digital playing field and apply taxes to imports of digital services. Many have also taken steps to apply taxes to the profits of the digital giants such as Facebook, Amazon, Apple, Netflix, Google and others, but the Canadian government has remained idle on the issue despite thousands of jobs lost in Canada’s media and cultural industries and hundreds of millions of revenues lost. C4TF estimates Canada loses hundreds of millions by not taxing foreign internet giants who also skew the market for domestic companies.

Lower fees for developers will translate to higher fees for residential owners.

Ford government to reduce fees for developers

Cities and residential owners could soon feel the squeeze after Conservative Ontario Premier Doug Ford announced plans to reduce charges for developers as part of the province’s housing plan. It also removes the requirement that new homes include infrastructure for electric vehicle charging. Development charges are the fees municipalities can charge real estate developers to recoup some of the additional capital and other costs of providing infrastructure and services to new housing and building developments. Reduced fees for developers will ultimately mean cuts to services or higher fees and taxes for residential property owners. Cuts to business property taxes across Ontario since 2001 have already led to an over $2 billion annual shift from the share of property taxes paid by businesses to residential property owners.

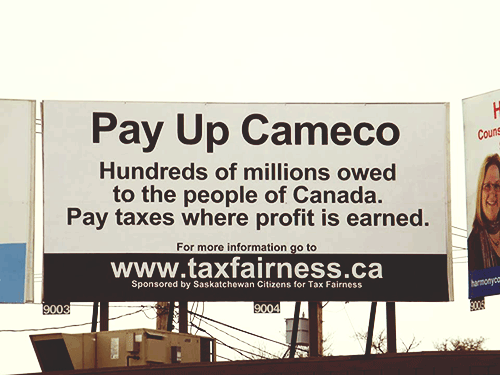

Saskatchewan Citizens for Tax Fairness erected this billboard in Cameco’s home province to raise awareness about weak corporate tax laws.

Cameco wins $10M for tax fight costs

The largest publicly-traded uranium mining corporation in the world—Canadian-based Cameco—was awarded $10 million to cover some of its court costs after successfully challenging the Canada Revenue Agency’s assessment that it owed back taxes. Cameco has been able to avoid over $2 billion in federal taxes by shifting its profits to a Swiss subsidiary. Despite booking many billions in profits in Switzerland, it hasn’t paid corporate income taxes in Canada in many years. It was a lengthy case that C4TF campaigned and lobbied on, but the Tax Court of Canada ruled in Cameco’s favour last year, a decision the CRA is appealing. This week’s news that the corporation can now collect multi-millions towards its court fees highlights what is wrong with the international corporate tax system and the need for Canada and other jurisdictions to fundamentally reform it so large corporations like Cameco can’t so blatantly avoid paying their fair share of taxes.

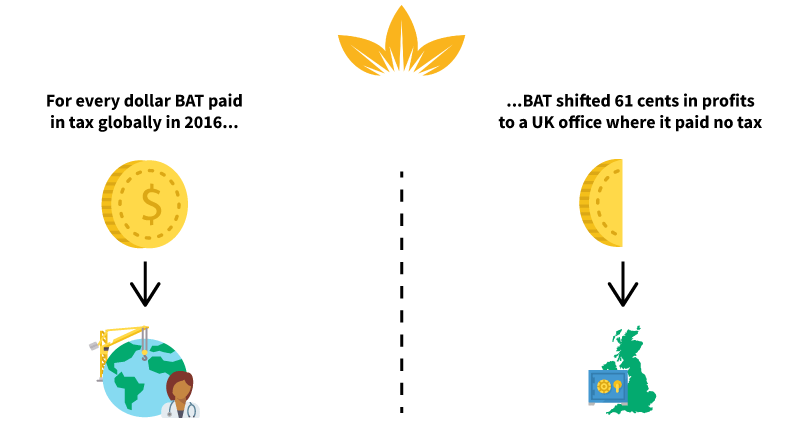

An infographic by the Tax Justice Network explaining how profit-shifting helped the world’s biggest tobacco company avoid paying taxes. TJN

The human cost of tax avoidance

The world’s largest tobacco company shifted profits to avoid paying at least $700 million in taxes, according to new research by the UK-based Tax Justice Network. An article in the Guardian this week details TJN’s findings that British American Tobacco moved profits from its overseas companies to its UK subsidiary to benefit from a lower corporate tax rate. The report highlights the regional effects of tax avoidance, pointing to a $5.8 million loss of revenue in Bangladesh, where the money could fund a year’s worth of health services for more than 200,000 people.