25 septembre 2020

Sign up to receive these monthly newsletters

Photo: Governor General of Canada Julie Payette prepares to deliver the Speech from the Throne, which included a number of tax fairness measures. Credit: Sgt Johanie Maheu, Rideau Hall

25 September 2020

By Erika Beauchesne

Important commitments for tax fairness in Throne Speech

The Trudeau government’s Throne Speech included a number of commitments to tax fairness that are encouraging. They include finding “new ways to tax extreme wealth inequality, “addressing corporate tax avoidance by digital giants” and introducing free automatic tax filing for simple returns.

After years of advocating to make tax filing easier, our hard work has paid off. Free automatic tax filing system will help ensure millions of low-income and vulnerable Canadians, who face barriers to filing their taxes, receive the benefits they are entitled to.

If individuals don’t file their annual tax and benefit form, they don’t receive significant government supports such as the Canada Child Benefit or the Guaranteed Income Supplement, which help reduce poverty. Dozens of other federal and provincial benefits also require annual filing: more than $50 billion of benefits for low and middle incomes annually. Under an automatic tax filing system, the government does simple tax returns for individuals, saving them time and money, while ensuring vulnerable citizens get the benefits they’re entitled to.

We celebrated this news in a media release, pointing out that now is a crucial time to adopt automatic tax filing as individuals who are most susceptible to the virus face even greater challenges now filing and receiving the supports they need.

The Throne Speech also promised to limit the stock option deduction tax loophole, a commitment it made in the previous budget. As we’ve argued before, it should go farther than this and completely eliminate the billion-dollar loophole, 90% of which benefits the 1%.

It recommitted to tax digital giants like Google and Facebook, part of its 2019 election platform. This time, the Liberals need to follow through and do more to tackle corporate tax dodging by Canadian corporations.

The speech also mentioned significant investments in areas such as a national early learning and childcare system and green technologies. These are welcome plans, but Canada can afford many other critical programs and services by making the tax system fairer and requiring the richest to pay their fair share. We will continue to push for more progressive tax reforms in a lead-up to the fall economic statement.

FinCEN files reveal role of financial institutions in global crime, corruption

Alarming Canadian connections were revealed in the latest investigative work from the reporters who brought us the Panama and Paradise Papers leaks. The International Consortium of Investigative Journalists and Buzzfeed News published their investigation into the FinCEN Files, which shows how banks helped move trillions in dirty or suspicious money across borders, facilitating illicit activity such as Ponzi schemes, terrorist financing and drug trafficking.

We wrote about Canada’s involvement in the scandal, including ranking 7th among countries for suspicious activity reports filed on individuals. A number of Canadian banks, including CIBC, RBC, TD, Bank of Montreal, UBS, and HSBC Canada were involved in 183 suspicious transactions.

An investigation by ICIJ partner Radio-Canada (English version here) also highlighted how Canada’s weak corporate transparency rules provide cover for international criminals. Reporters tracked down Canadian shell companies in the FinCEN files that received millions in suspicious funds and found companies were incorporated in Alberta and News Brunswick despite having zero legitimate business activity or beneficial owners there. Some companies linked back to tax havens like the Seychelles and others to alleged illicit activity including insurance fraud and illegal fishing in Russia.

Together with our coalition partners Transparency International Canada and Publish What You Pay Canada, we published a statement reiterating our call for increased corporate and financial transparency. We will continue to advocate for a publicly accessible, pan-Canadian registry of beneficial owners to identify who owns corporate entities and push criminals out from the shadows.

Our coalition recently released three reports exploring the benefits of a public registry to help government tackle money laundering, tax dodging, and other illicit activities. You can read our reports on the coalition website, along with a letter we wrote to Canada’s new Finance Minister Chrystia Freeland, making the case for a public registry.

On Monday, Sept 28, our coalition is hosting a webinar with updates on our campaign to end snow-washing in Canada. The webinar runs from 2-3 p.m. To register, please email Sasha Caldera (scaldera@pwyp.ca)

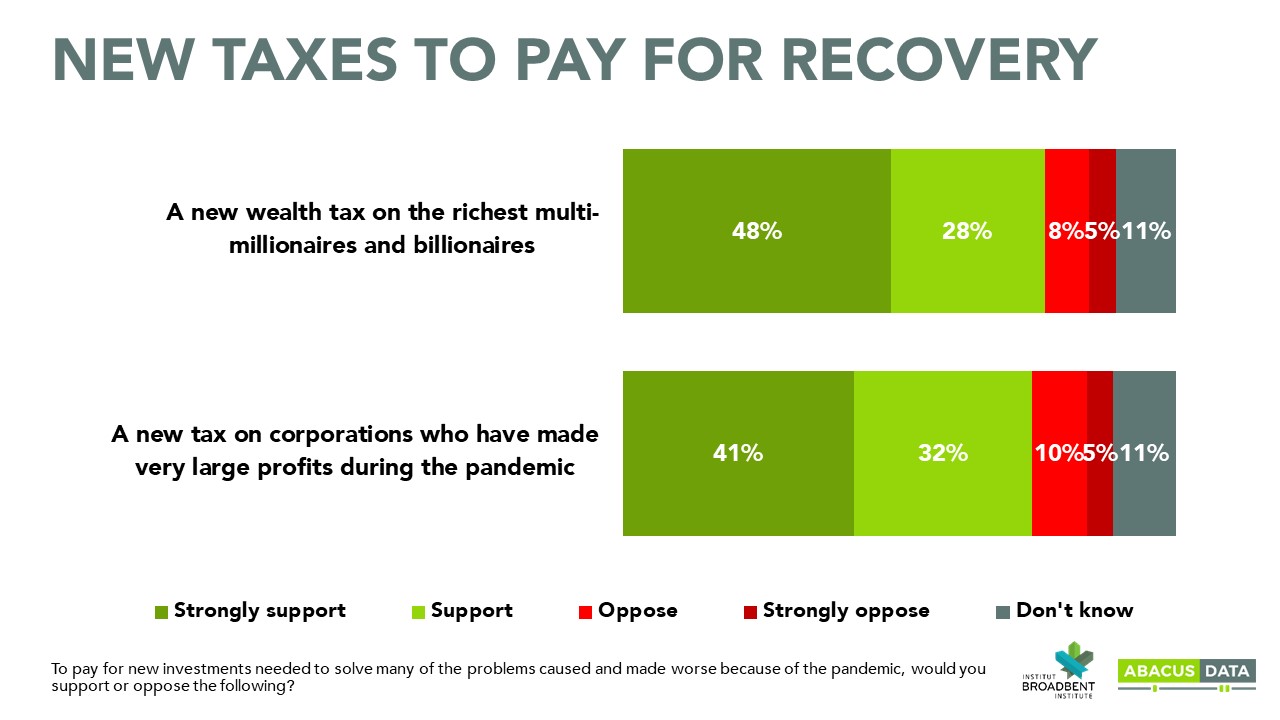

New polling last month from Abacus Data, commissioned by Broadbent Institute, found majority support for taxing the rich and profitable corporations. Graphic: Abacus Data

Pandemic profiteering highlights need for tax reform

As COVID-19 continues to take its toll on workers and households, a handful of large corporations are set to make a killing this year. New research from Oxfam found half a billion people around the world will be thrown into poverty due to the economic impact of the pandemic but 32 of the largest companies stand to see profits jump by $109 billion more in 2020. Oxfam’s report looks at how large corporations have put profits ahead of worker safety and pushed costs down the supply chain.

Corporations aren’t the only pandemic profiteers. A new report from the Canadian Centre for Policy Alternatives found the wealth of Canada’s top 20 billionaires has ballooned by $37 billion since the pandemic.

Canadians for Tax Fairness is renewing calls for the federal government to close tax loopholes for the wealthy, implement an excess profits tax on large corporations that do well during the crisis, and tax the super rich. In August, NDP MP Peter Julian introduced a motion for a 1% wealth tax on fortunes over $20 million (sign his petition here). These and other tax reforms would raise revenues to help pay for COVID-19 and reduce disparities that have been exacerbated by the crisis.

The government not only has a fiscal incentive to make the tax system fairer, but a political one. New polling by Abacus Data found a majority of Canadians want Parliament to tax the rich and corporations that profited greatly in the pandemic in order to pay for a bold recovery plan.

The Broadbent-commissioned survey found 76% support a tax on the wealthiest Canadians while 73% support a tax on corporations that made large profits in the pandemic. Even some multi-millionaires in Canada are urging the government to tax their wealth in order to tackle inequality, as this CBC story explores.

Requiring those at the top to contribute more to the economic recovery is gaining traction around the world. New Jersey recently introduced a tax on millionaires to address the fiscal crisis. Recent polling the UK found 74% want to tax the super rich, including 64% of Conservative voters. Previous polling in Canada also found support for a wealth tax across all party lines.

OECD corporate tax reform discussions to resume after pandemic pause

Discussions through the OECD to reform international corporate tax rules and tax the digital economy are expected to resume after being put on hold by COVID-19. The Inclusive Framework on BEPS will meet in early October with talks expected to continue at the G20 Ministers meeting later this fall.

In the absence of a global consensus, many countries have gone ahead with plans to tax digital giants on their own. This op-ed in La Croix (French) outlines why governments should act unilaterally rather than waiting for an international agreement.

Large multinational corporations pay low rates of tax, which not only deprives governments of revenues but creates an unfair playing field for their smaller domestic competitors. With their growing revenues and market power, giants like Amazon, Google and Apple recently revealed they will pass the cost of new digital services taxes onto consumers via additional fees.

It is not only tech titans that are able to avoid taxes using offshore accounting schemes. In our recent report on Canadian corporate tax haven use, we identified companies from a range of industries such as resource extraction, retail, hospitality and real estate. The Canada Revenue Agency sometimes challenges these MNEs in court for foregone tax revenues, but it rarely wins, highlighting the need to change corporate tax rules both at home and internationally.

Earlier this summer, the CRA lost a multi-million-dollar case against Loblaw over its use of a subsidiary bank in Barbados. The agency also lost a $2-billion case against Cameco related to the company’s use of a subsidiary in Switzerland. Last month, it lost a similar case to two agribusiness corporations.

With billions at stake, Canada must take a stronger role on the international stage in promoting tax fairness and follow through at home with its promise to tax large foreign digital corporations.

Major world summit on tax fairness and cooperation this October

Mark your calendars! TAXCOOP 2020: the World Tax Summit, focusing on the distribution of wealth and tax cooperation, will be held October 13-15 in Montreal. And because it will be all on-line, registration is free for everyone.

The virtual summit will feature a range of tax-related topics, from environmental tax reform, women and taxation, and taxing the digital economy, with over 100 guest speakers, including prominent politicians, academics, CEOs, researchers and activists. C4TF director Toby Sanger will speak on a panel about tax justice and the wealth gap along with representatives from Échec aux Paradis Fiscaux and Tax Justice Network.

This is the sixth annual TAXCOOP conference—started and organized by Canadian tax experts Brigitte Alepin, Lyn Latulippe and Louise Otis—and because it is virtual and free, will be the most accessible ever.

Register at: https://taxcoop.org/en/